GGRX is minting a CARBION token, a data-backed, monetizable asset that goes beyond traditional standards, as it built off of an AI/ML data model to provide data validation for the value of the token and smart contracts. It integrates energy efficiency certificates, renewable energy production, and peak-shaving initiatives, unlocking economic and environmental value.

The responsible use of carbon credits is our goal, and the path to that is through verified carbon credits. There has been much criticism of carbon credits in the past, as well as examples of greenwashing by companies and projects that violate best practices. This needs to change if carbon credits are to play a major role in helping us decarbonize. In short, companies and individuals need to be educated on the responsible use of carbon credits.

White Papers

The intersection of cybersecurity, data trust, and sustainable energy solutions presents a unique opportunity to enhance the reliability and value of energy efficiency certificates and carbon credits.

In the realm of energy efficiency and sustainability, securing data from devices, systems, and operational analytics is crucial for ensuring trust, auditability, and compliance. Furthermore, the use of AI to normalize, analyze (i.e. anomaly detection) or to make predictions warrants data trust models to establish an audit trail of how data gets transformed.

This concept paper presents an integrated approach to automating the identification and certification of energy savings by combining trusted operational data with advanced data science analytics.

Ecosystems

What Are Carbon Markets?

There are both compliance markets and voluntary carbon market (VCM) where carbon credits are traded actively as a means to finance sustainability projects.

Voluntary carbon market (VCM): Businesses and individuals driven by sustainability goals can choose to offset their emissions. Traditionally, they would purchase credits from various projects through carbon registries such as Verra, Gold Standard, International Carbon Registry (ICR), Puro Registry, American Carbon Registry (ACR) and Climate Action Reserve (CAR) etc. not linked to specific state-mandated compliance schemes.

In the voluntary markets, carbon projects are required to follow specific methodology standards and are subjected to a strong verification process from carbon credit registries to ensure credit quality and impact.

Compliance market: These operate under mandatory government regulations like cap-and-trade systems in Europe, California, or Colombia. Entities exceeding their allocated emission limits must purchase credits from verified projects to comply. Such credits are issued and tracked through government-sanctioned registries.

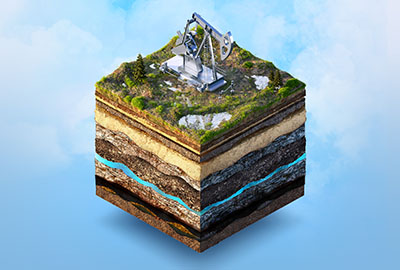

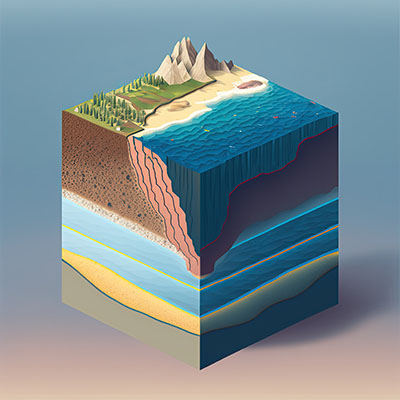

What Are Carbon Pools?

Carbon pools are reservoirs of carbon that have the capacity to both take in and release carbon. There are four very broad global carbon pools which encompass many complex systems which will be discussed on this page. Each of these pools exchange carbon with one another, known as carbon fluxes, comprising what is known as the global carbon cycle.

- An inorganic reservoir of carbonate rock, estimated to hold 50,000,000 to 100,000,000 GtC (Gigatonnes of Carbon).

- A "fossil" reservoir of organic matter which contains the world's fossil fuels - such as coal, oil, and natural gas - which formed over millions of years (see oil formation for more information) and is currently being depleted by humans. The reserves of these fossil fuels contains 1000-2000 GtC. Normally there would be no flux of this carbon into the carbon cycle, however through human actions this carbon is introduced into the other carbon pools unnaturally.

- Living matter, mostly found near the surface, consisting of roughly 3 GtC.

- Carbon dissolved throughout the ocean, where the majority of the carbon is, at around 37,000 GtC.

- Sedimentary matter, containing mostly carbonates.

Benefits of Carbon Pools

Carbon Pools provide a number of benefits to the digital carbon market, enhancing project-specific tokenized carbon credits:

- Quality Assurance through Gating: Rigorous selection criteria ensure projects meet stringent quality standards for emissions reduction, methodology, and social impact, guaranteeing participants they are supporting verified, high-impact initiatives. Carbon pools make it easy for market participants to evaluate the relative quality of carbon credits compared to carbon pool tokens.

- Diversification through Variety: Carbon pools group diverse projects across sectors and geographies, offering participants exposure to a wider range of environmental solutions, reducing risk and maximizing impact.

- Simplified Access, Amplified Action: Pools aggregate multiple projects into single tokenized units (e.g., Base Carbon Tonnes), removing complexities and offering streamlined entry points for individuals and smaller entities, democratizing access and driving broader participation in climate action.

- Standardization Fuels Liquidity: Carbon pools achieve uniformity through established standards, allowing for the creation of fungible tokens (e.g., BCTs) representing verified emissions reductions. This standardization facilitates the formation of a single liquidity pool, where fractionalized token ownership enables easier buying, selling, and trading. This increased liquidity benefits all participants, offering flexibility and efficiency in the carbon offset market..

The Role of Blockchain-Enabled Markets

The VCM has been around for decades and has become an integral mechanism for raising climate finance. It has however had its growth inhibited due to difficulties relating to market accessibility, transparency, illiquidity and high transaction fees. GGRX provides dynamic solutions for the Web3 ecosystem aim to develop new technologies and governance mechanisms which leverage the blockchain for the carbon markets.

Carbon Credit Tokenization

In order to make use of carbon credits on the blockchain as digital carbon, carbon credits must be "tokenized" or bridged onto the blockchain from a traditional carbon registry via a carbon bridge. Tokenization allows the integrity of the carbon credits that have been issued in accordance with rigorous carbon standards to be maintained, but for them to benefit from the market infrastructure develop on the blockchain.

While the technical details of each bridge may differ, the process of bridging and tokenizing carbon credits is generally similar. Carbon credit holders (such as project developers, traders, and corporates) can initiate the bridging process by submitting verified carbon credits to their chosen bridge. Upon successful transfer, the bridge seamlessly tokenizes the credits, translating each verified ton of carbon into a unique digital token on the blockchain. Key characteristics of the carbon credits are brought on-chain when it is transformed into a tokenized digital carbon credit.

Economics

Coming soon...